While certain heavily shorted stocks are getting much of the attention lately due to retail-driven price surges, the bigger picture news is Q4 earnings reports and analyst behavior.

We track earnings estimates for a broad universe of about 2300 US stocks (market cap of $200 million and up) and construct estimate revisions indicators using two key metrics: breadth and magnitude. Breadth is the net proportion of analysts raising versus lowering estimates for a stock, which is -100% if all analysts are cutting their earnings estimates and +100% if all are raising estimates (0 indicates a balance between positive and negative revisions, or no activity at all). We look at this proportion based on revisions that occurred over the last 100 calendar days (about one quarterly reporting cycle).

Magnitude is the size of the changes, measured as the percent change in consensus mean earnings (EPS) estimates over the past month. It will thus be more sensitive but also more volatile.

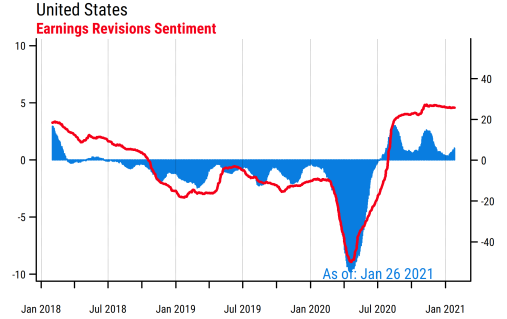

The first chart below shows the average daily readings of those two indicators for all US stocks. The red line is the average revisions breadth and the blue bars are the average revisions magnitude. We can see that revisions breadth is holding at very high levels (the long-run average is actually slightly negative because analysts tend to start off with high estimates and trim them as time goes on). This means that a solid majority of stocks have more analysts raising than cutting their estimates for earnings over the next 12 months, and this has been the case consistently since July.

The blue bars are now starting to rise again, and we can clearly see the quarterly reporting cycle in the data. The earnings season for Q2 2020 earnings that started last July provoked a big upswing in revisions magnitudes (due to a high proportion of earnings reports beating consensus estimates), and then the reports for Q3 2020 earnings three months later also provoked a similar jump in estimates.

Right now, we see what looks like a third consecutive acceleration in estimate revisions developing as Q4 2020 earnings are now being reported, and are mostly coming in better than consensus expectations. So even after months of analysts raising estimates, they are still being surprised positively by the actual earnings reports.

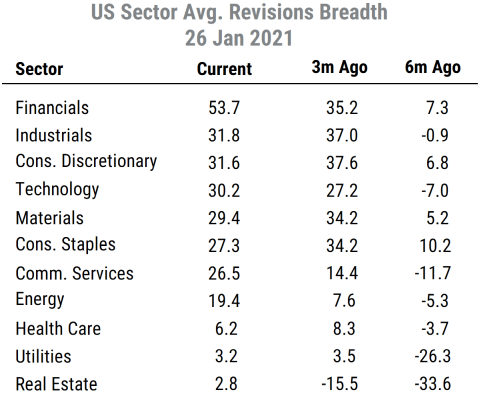

Where are revisions strongest? The table below shows the average revisions breadth readings for the 11 GICS sectors in the US (using the same broad universe of stocks). We see that Financials is at the top, with a very high reading of over 50%. While Financials have had strong revisions for a while now, the latest jump is likely because Financials are among the first to report earnings in a given quarter and most have reported positive surprises so far: 30 of the 34 Financials in the S&P 500 which have reported so far have beaten consensus estimates for Q4. Analysts often then respond to “earnings beats” by raising estimates for future quarters.

Beyond Financials, it is still mostly cyclical areas that have the strongest revisions activity, including Industrials, Consumer Discretionary, Technology, and Materials. And while all sectors have net positive revisions breadth, the weakest by a considerable margin are Real Estate, Utilities, and Health Care.

Beyond Financials, it is still mostly cyclical areas that have the strongest revisions activity, including Industrials, Consumer Discretionary, Technology, and Materials. And while all sectors have net positive revisions breadth, the weakest by a considerable margin are Real Estate, Utilities, and Health Care.

So the message from analysts continues to be strongly favorable for future earnings expectations, even after two consecutive quarters when earnings beat expectations substantially. The macro influences of fiscal and monetary policy on corporate earnings are now well established and likely being embedded in analyst forecasts. This is clear from the relative strength in the cyclical sector revisions indicators.

While equity markets have jumped sharply over the last three months and potentially priced in a lot of good news, the positive trend in earnings estimates from analysts that has supported equity prices thus far looks to be intact for now.