Earnings reports for Q1 are coming in very hot once again, even after several consecutive quarters of beating consensus expectations. Analysts seem to still be struggling to keep up with the strength in US earnings, and continue to raise their earnings estimates.

To be fair, analysts have never had to deal with the level of volatility and uncertainty in the macroeconomy that has been seen in the last year or so. The shock of COVID-19 and associated shutdowns in economic activity, followed by unprecedented levels of fiscal and monetary stimulus, and the record-breaking speed of vaccine development are all extraordinary events that most analysts following individual companies are not traditionally prepared to incorporate into their earnings forecasts. The limitations on travel and uncertainty among company executives themselves are also likely hampering analysts in producing their earnings forecasts.

The latest data from Factset show that about half of S&P 500 companies have now reported Q1 earnings. The bottom line is that earnings reports have been extremely positive so far, beating estimates broadly and by wide margins once again.

- 47% of companies have reported (238 of 505)

- 86.5% have reported positive earnings surprises – one of the highest readings on record and in line with the big beats in Q2 and Q3 of last year

- 80.3% have reported positive sales surprises

- Aggregate year-on-year quarterly EPS growth for Q1 is running at 43% right now (blending actual reports with estimates for those not reported yet)

- Financials has been the biggest contributor so far, followed by Technology

The aggregate S&P 500 estimates for calendar 2021 are also rising. Full-year EPS growth for 2021 is now expected to be +31%, up from a consensus of +18% at the start of this year.

Turning to actual earnings levels, current S&P 500 consensus EPS is $179.45 for 2021 as reported by Factset, and $203.03 for 2022. For context, the final 2020 EPS figure was $137.99, and 2019 was $160.41, so 2021 earnings will be substantially above pre-COVID 2019 levels.

And mid- and small-caps are also beating estimates broadly so far. For the S&P 1000 index (which is the combination of S&P 400 MidCap and S&P 600 SmallCap indices), with 34% of the companies having reported so far, 87% have reported positive surprises, also led by Financials.

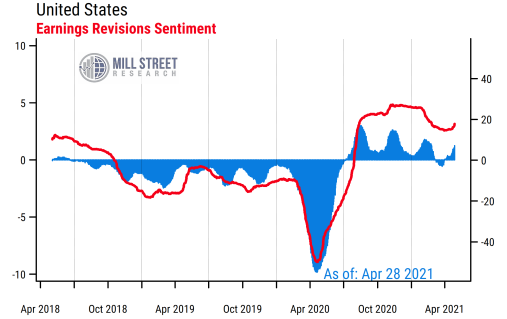

When we look at our own aggregated indicators of earnings estimate revisions, as shown in the chart below, which measure the breadth (red line) and magnitude of changes (blue bars) to estimates over the next 12 months, we see continued net positive revisions trends in our broad (2300-stock) US universe. And we again see the impact of the quarterly earnings season showing up in the data as companies beat estimates and analysts have to raise their future forecasts further.

Source: Mill Street Research, Factset

Source: Mill Street Research, Factset

With such strong earnings momentum, it is less surprising that stock prices have been rising steadily with few meaningful pullbacks recently. And with the Fed yesterday reiterating their stance that they will keep their current aggressive monetary support in place for some time despite the latest signs of economic recovery and inflation pressures, asset prices should continue to have tailwinds until all the good news becomes fully priced in.