30 September 2021

As Q3 ends and with reporting season set to begin in the coming weeks, we can update the current consensus earnings outlooks for Q3 and Q4 as well as calendar year 2021 and 2022 for the S&P 500. Earnings should be up a lot from last year, but uncertainty among analysts remains quite high.

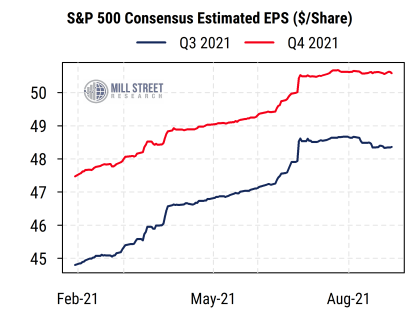

For Q3, S&P 500 earnings are expected to be up 28% from a year ago according to Factset, another big percentage gain. That figure is higher than it was at the start of the quarter (it was 24% on June 30th) but has been stable since July and down marginally since the end of August. So the pace of gains in aggregate index earnings has eased, but estimates are still rising modestly on balance.

Operating EPS expectations for Q3 of $48.35 per share are higher than all pre-COVID levels but expected to be slightly below Q2’s record reading of $52.36.

Despite the recent concerns about cost pressures, natural disasters, and China’s weakness, consensus continues to call for strong double-digit earnings growth in Q4 as well, with the current estimate of $50.62 expected to be up 22% from Q4 2020. That figure is unchanged from a month ago.

Source: Mill Street Research, Factset

Source: Mill Street Research, Factset

The Q3 earnings reports and associated commentary/guidance will likely be key in determining whether analysts need to be more cautious in their forecasts for Q4 and 2022 or not.

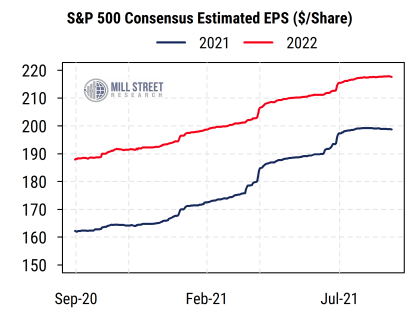

The current consensus S&P 500 EPS for calendar 2021 is now $198.76 (giving a 2021 P/E of 21.9 for the S&P 500), while the consensus for 2022 is $217.52 (P/E of 20.0).

The 2021 figure is down slightly from one month ago, but still much higher than it was at the start of Q3. The 2022 figure is up slightly from a month ago and also well above the level at the start of Q3.

Source: Mill Street Research, Factset

Source: Mill Street Research, Factset

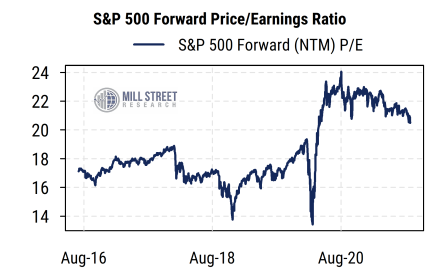

The recent pullback in stock prices has brought the forward (next 12 month, NTM) P/E for the S&P 500 down somewhat further, now just above 20 (or an earnings yield of about 5%). This is still above pre-COVID levels, but significantly below the levels since a year ago. This 5% earnings yield still compares favorably with the 10-year Treasury yield of about 1.5%.

Source: Mill Street Research, Factset

Source: Mill Street Research, Factset

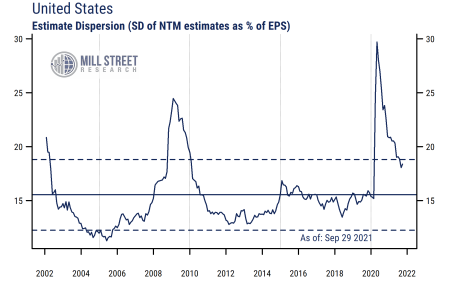

The other key point, which is perhaps not surprising but bears mentioning, is that uncertainty about corporate earnings among analysts remains quite high relative to historical norms. The range of estimates around the mean (consensus) among US stocks is still well above the normal range seen outside of recessionary periods.

Source: Mill Street Research, Factset

Source: Mill Street Research, Factset

This suggests that even though GDP and earnings have been rebounding strongly recently, all of the uncertainty about policy, supply chains, the path of COVID and vaccinations, extreme weather, etc. is still provoking a lot of disagreement among analysts as to how much companies will make over the next year.