8 June 2022

Gasoline prices remain in the headlines, and leave an impression every time a driver fills their tank as prices hit new highs.

Oil prices are a global issue, with OPEC and the US being the biggest producing regions. Producers face mixed incentives about increasing production longer-term, including messages from the futures markets.

Gasoline and diesel refiners face reduced capacity, leaving them struggling to meet even historically normal levels of demand despite high potential profit margins.

Fiscal and monetary policy makers globally are trying to deal with the jump in energy prices, as are investors, though policy makers outside areas like the Middle East have little short-term influence on energy costs.

Since we have received a number of questions about this topic from clients, we thought it would be worthwhile to review some of the key indicators we watch, especially with the recent news of OPEC potentially increasing production to compensate for Russia’s reduced output.

Yes, gas prices are quite high relative to the last 15 years.

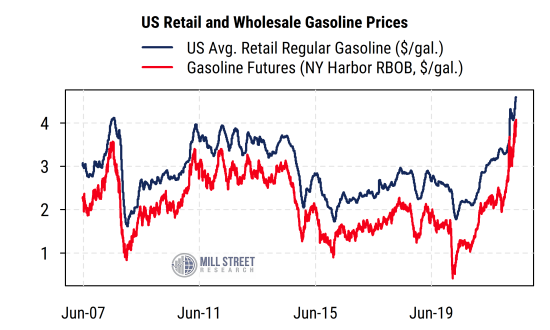

The chart below shows the average retail regular gasoline price in the US, as well as the futures (wholesale) price that tends to lead retail prices by a few weeks. Retail gasoline prices are about $4.59/gallon according to the Dept. of Energy, and futures prices were just about $4.00 recently. Both are now higher than the previous peaks in 2008 and 2011-13.

Source: Mill Street Research, Bloomberg, Factset

Source: Mill Street Research, Bloomberg, Factset

Gas prices are not yet at records after adjusting for inflation

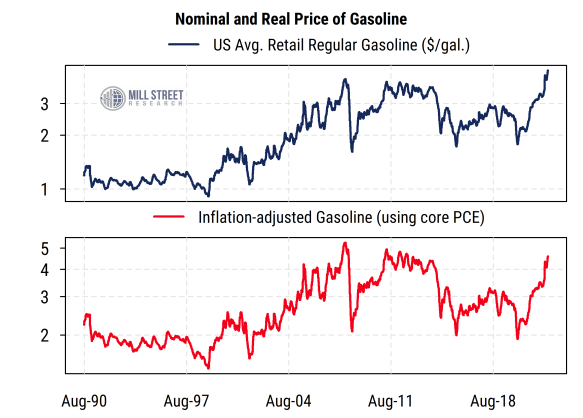

The chart below shows a longer-term look at the average retail gasoline price in nominal terms (top section), and after adjusting for inflation using the core PCE price index (i.e., excluding food and energy, to avoid counting gas prices in the inflation measure itself). Thus far, gas prices in real terms are not yet at new highs, but nearing the inflation-adjusted levels of 2011-13 and 2008.

Source: Mill Street Research, Bloomberg, Factset

Source: Mill Street Research, Bloomberg, Factset

Gas prices have risen faster than crude oil prices lately, but are within the historical range on a relative basis.

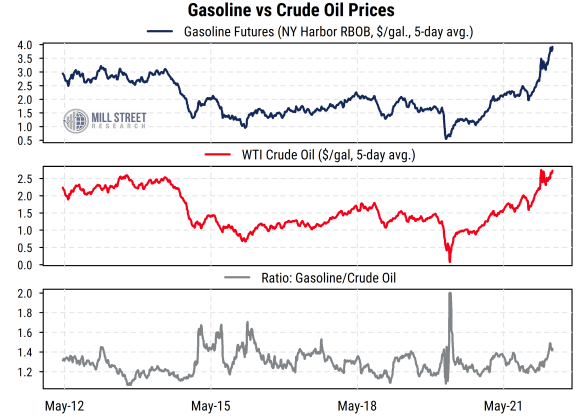

The chart below shows the futures (wholesale) price of gasoline over the last 10 years along with the price of West Texas Intermediate (WTI) crude oil (converted to dollars per gallon for comparative purposes). The bottom section shows the ratio of the price of gasoline to the price of oil per gallon.

Historically, gasoline has been priced roughly 30% (1.3x) above crude oil on average, reflecting the cost of refining and transportation. The recent rise in the grey line indicates gasoline rising faster than crude oil, a trend driven by refinery capacity issues, as we discuss below. But gasoline is not especially expensive relative to crude oil in the context of the 10-year history, with the current gas/oil ratio showing gasoline at a 43% premium (1.43x). Aside from a brief spike in 2020 when crude prices plunged to zero, the ratio was above 1.6 several times in the 2015-16 period (a period with much lower oil and gasoline prices).

Source: Mill Street Research, Bloomberg, Factset

Source: Mill Street Research, Bloomberg, Factset

Major issue for gasoline and diesel: refinery capacity is down

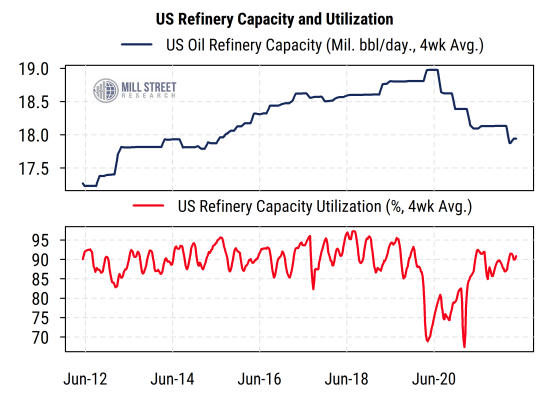

Based on US Dept. of Energy (DOE) data, US operable oil refinery capacity has declined substantially since mid-2020 and remains near its lowest level since 2015. This is due to refinery capacity cutbacks provoked by the drop in demand caused by COVID, as well as plants being idled due to damage, maintenance, or regulatory reasons. Refiners looking ahead five to 10 years are likely seeing a longer-term decline in demand for gasoline and diesel as interest in renewable fuel sources increases, and thus have not added to capacity, and likely will not build new refineries in the US.

The utilization rate of the refineries has been rising as demand has recovered, now back above 90%. Thus there is a potential bottleneck right now in turning oil into gasoline for use in the US, causing gasoline to be more expensive relative to crude oil than it has been in recent years.

Source: Mill Street Research, Bloomberg, Factset

Source: Mill Street Research, Bloomberg, Factset

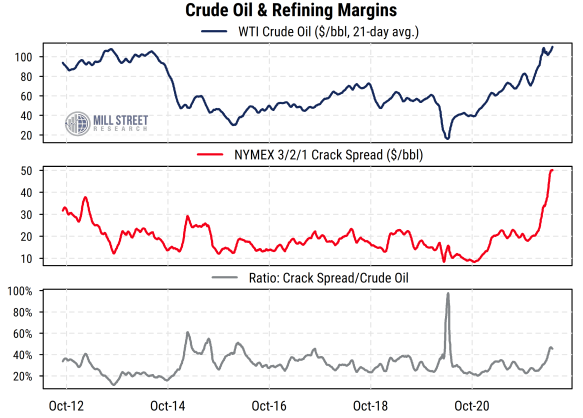

Refiners have incentive to produce: refining margins are high

The profitability of refining crude oil into gasoline, diesel, jet fuel and other distillates is much higher now thanks to recovering demand and limited capacity. The so-called “crack spread” is a rough measure of the value of gasoline and diesel (heating oil) produced by refining a barrel of crude oil. As a rough rule of thumb, three barrels of oil can be refined (or “cracked”) into two barrels of gasoline and one barrel of diesel. Thus the “3/2/1 crack spread” is the difference between the value of the gasoline and diesel versus the price of the oil used to create them. It therefore is a proxy for how much potential gross profitability oil refiners might expect.

Right now, the crack spread is very high (around $50/bbl), much higher than most of the last 10 years. However, the price of oil is also high, so the crack spread relative to the price of oil (i.e. refining margins on a percentage basis) is high but not at a historic extreme (it was higher in 2015-16, for instance). Refiners clearly have a price incentive to produce more gasoline and diesel, but are likely limited by capacity. These high margins help explain the persistently strong earnings estimate trends seen in refining companies recently. They may not, however, be sufficient to cause firms to invest in new refinery capacity, given the long-term demand trends.

Source: Mill Street Research, Bloomberg, Factset

Source: Mill Street Research, Bloomberg, Factset

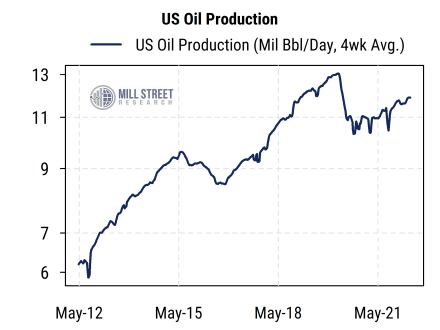

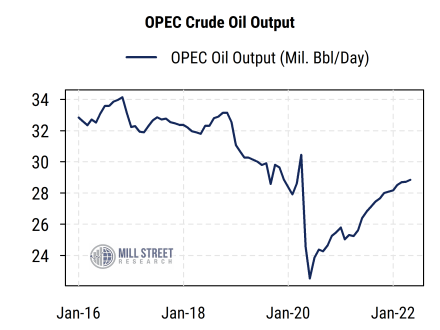

US oil production has risen, but still well below pre-COVID levels; OPEC has been cautious so far, but may be changing its tune

US oil production has been gradually increasing from its COVID lows, but is not yet at pre-COVID levels. Total US oil output is running at about 11.9 million barrels/day, still some distance from the early 2020 peak just above 13 million.

A somewhat similar pattern can be seen in the aggregate output from OPEC countries – output is now near immediate pre-COVID levels (estimated at about 29 million barrels/day) but below output levels from the 2016-19 period. OPEC recently announced a larger-than-expected increase in its production quotas in response to the EU’s partial ban on Russian oil imports. However, analysts are skeptical about whether OPEC can in fact increase production by the full amount of the new quotas, given that some OPEC members are already pumping as fast as they can (and the swing producer, Saudi Arabia, may not make up the difference).

Source: Mill Street Research, Bloomberg, Factset

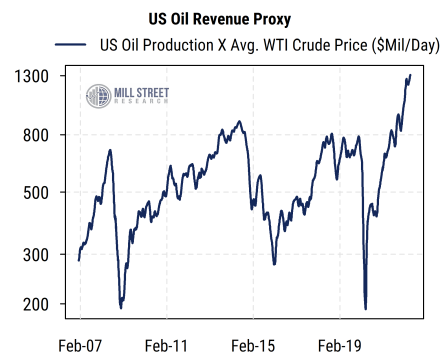

US oil producers have plenty of revenue, may be hesitant to increase production substantially

Despite calls by some politicians and other commentators, US oil producers likely do not feel the need to dramatically raise production, since they are already bringing in very high levels of revenue: our rough proxy for gross US oil revenues has jumped to new highs. This metric is simply the Department of Energy’s estimate of US oil production per day (on a rolling monthly basis) multiplied by the monthly average price of a barrel of crude oil. It indicates roughly $1.3 billion/day in gross revenues (not profits), far higher than the previous peaks of around $800 million/day. This reflects the mixture of relatively high production and very high crude prices, a combination which has not happened before in the limited history of the US being a major oil producer. Note that global (ex-US) oil production by US companies is not included in these data.

Oil producers often must project demand out 3-5 years (or more) to decide whether to drill more oil, due to the time and cost required. If they expect demand to fall off in the longer-term due to reduced fossil fuel use, they may be hesitant to rush into higher oil production now, even with high prices. This is especially true given that they were burned in 2008 and 2015-16 by sharp drops in demand after increasing output. The high revenues for US oil producers do not reflect “price gouging”, but are a natural result of the current state of supplies constrained by COVID, war, and decarbonization trends relative to demand. Indeed, markets are pricing in much lower crude prices longer-term, as shown below.

Source: Mill Street Research, Bloomberg, Factset

Source: Mill Street Research, Bloomberg, Factset

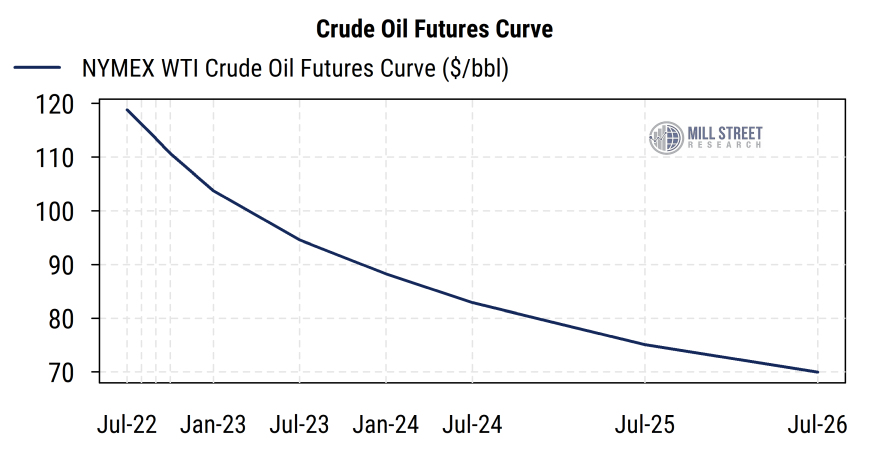

Crude futures show extreme “backwardation”, raising the risks for increased oil production

One of the key pieces of market information used by oil companies in making their longer-term plans for new drilling or refining is the crude oil futures curve. The New York Mercantile Exchange (NYMEX) offers futures contracts on the benchmark US West Texas Intermediate (WTI) crude oil price going out up to 10 years. While the longer-term contracts are less actively traded, they reflect the current market price expectations, and thus factor heavily into oil company projections.

The current oil futures price curve is shown below with various contract prices going out as far as four years from now, and we can see that the curve is severely downward sloping (or in “backwardation” in futures parlance). One might normally assume that oil to be delivered in the future should be priced higher than oil to be delivered now (a condition known as “contango”), due to the costs of storage, insurance, and financing, or expectations that demand will grow over time with the economy. Backwardation results when current prices are viewed as the result of a temporary shortage, but investors expect that demand will ease (more electric cars?) and/or supply will increase (OPEC raises production, or Russia comes back in a few years?) in the longer-term and force prices lower, even after accounting for carrying costs.

The current backwardation (downward slope) in futures prices is historically extreme, and tells oil executives that they cannot count on being able to sell oil several years from now at anywhere near the current price: markets are priced around $70/bbl four years from now compared to about $118/bbl currently. This highlights the unusual nature of the current market conditions, and makes the prospect of investing in new production (which often takes years to come online) much riskier.

Source: Mill Street Research, Bloomberg, Factset

What can we conclude from these indicators?

- It’s no lie: oil and gasoline prices are currently quite high, largely due to Russia’s output being limited by sanctions following its invasion of Ukraine, and OPEC’s reticence (or inability) so far to sharply increase output.

- Reduced capacity among US refiners means that even normal demand for gasoline and diesel is enough to push prices up, and refiners would likely prefer to produce more in the short run if they could given the price incentives they face. Increasing capacity looks unappealing given the cost and time involved in light of longer-term demand trends.

- Oil producers also face mixed incentives, given the long lead times involved in new oil production, as they have a very real worry that building out more drilling capacity would bring new supply on just about the time demand slows down again, and this scenario in fact seems to be priced into current oil futures market prices. Oil producers are making plenty of money right now at current production levels, and investors mostly want any excess profits returned to them as dividends or buybacks, rather than invested in new production. There is little evidence of true “price gouging” beyond supply and demand influences.

- There is very little that the US president or Congress (or other Western governments) can do to influence oil or gasoline prices in the short run, since domestic supply and refining capacity cannot be changed quickly and is to a large degree in private hands, while oil is very much a global market where the US is a large but not controlling player.

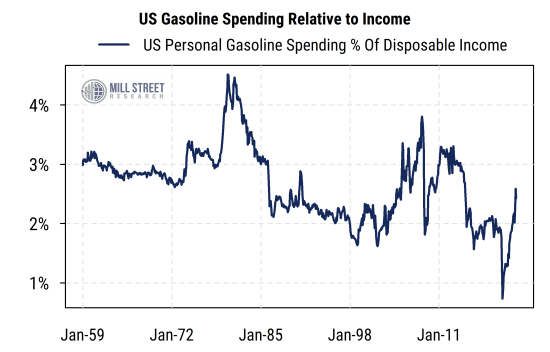

- US drivers are paying higher fuel prices, but on a real basis they have paid such prices before and survived. Also, the changes in fuel efficiency and driving patterns have meant that total spending on fuel as a proportion of disposable personal income is only now approaching its long-run average of about 2.6%, and is sitting right at the latest 20-year average of 2.4% (chart below). In the Consumer Price Index, which is constructed differently, motor fuels make up 3.8% of the weight. Either way, in terms of overall budget impact on US consumers, the impact of gasoline prices is much less than the psychological impact from a very salient price in most people’s lives.

- Thus the aggregate change in consumer fuel spending relative to the January 2020 levels is not as large as the recent jump from the post-COVID trough makes it seem, even if it helps sell newspapers.

Source: Mill Street Research, Bloomberg, Factset

Source: Mill Street Research, Bloomberg, Factset