8 July 2021

As we have discussed for some time now, equity analysts are raising their forecasts for corporate earnings more broadly and by larger amounts than at any previous time in our 20-year data history. However, while analysts are confident earnings are rising, they still show significant uncertainty about the future level of earnings, as reflected in the dispersion or disagreement in estimates for US companies.

In addition to tracking the trends in analyst forecasts for earnings (i.e., the change in the consensus mean estimates for each company), we also track the dispersion of estimates around the mean for each company. That is, it can also be useful to see how much agreement or disagreement analysts have about their forecasts as a group.

As an example, assume Company A and Company B both have a mean (average) earnings forecast of $1.00 per share over the next 12 months (and both have, say, 10 analysts providing estimates). If the analysts covering Company A show a range of estimates from 0.80 to 1.20 per share, while those covering Company B show a range of estimates of 0.90 to 1.10 per share, then we know that analysts (as a group) have more uncertainty or disagreement about Company A’s earnings than about Company B’s earnings. We call the range around the average estimate the level of dispersion of estimates, and can track the figures in aggregate over time, using the range as a percentage of the mean estimate for each company (40% for Company A and 20% for Company B).

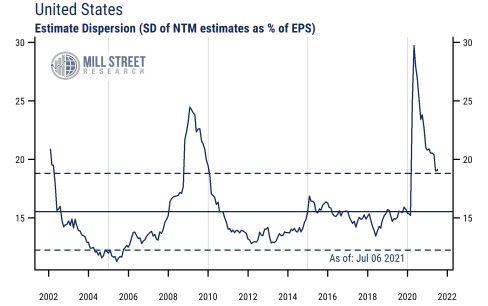

It should come as no surprise that the degree of uncertainty (dispersion) about earnings suddenly surged early last year when the impact of COVID-19 first became evident, as can be seen in the chart below, showing the average dispersion of estimates across all 2300 US stocks we track. Indeed, the uncertainty was more extreme than in the 2008-09 Great Financial Crisis. Since then, earnings uncertainty has declined and earnings estimates have been rising strongly as stimulus and the impact of COVID vaccinations have allowed US corporate earnings to recover quite dramatically.

Source: Mill Street Research, Factset

Source: Mill Street Research, Factset

However, even with earnings back at pre-COVID levels and analysts still raising estimates broadly, uncertainty about earnings remains quite elevated relative to the levels in the decade prior to last year. Even after many companies have resumed giving earnings guidance and much of the last year’s fiscal and monetary policy impacts are now well known, analysts are significantly more unsure than usual about how much US companies will make (on average) over the next 12 months. Note that the solid horizontal line in the chart indicates the long-run average dispersion level, and the dashed lines indicate the one standard deviation range around that average.

Why are analysts still so uncertain about their earnings forecasts? Various reasons come to mind. The ongoing impact of COVID-19 globally remains a key source of uncertainty — even as the US has made great strides in vaccinations, much of the rest of the world has not, and the Delta variant has raised fresh concerns. Future fiscal policy, including the current infrastructure proposals in Congress now, remains both crucial and uncertain, as does the more extreme state of politics in general. Supply chain disruptions and volatile commodity prices continue to have a significant impact on earnings forecasts as well (the Energy sector has especially high earnings estimate dispersion right now). Even the weather is more of a source of uncertainty than usual as many weather-related records are being broken recently, with direct and indirect impacts on corporate earnings.

Will analyst uncertainty return to the “normal” levels seen in most of the 2010s and mid-2000s, or are things structurally less predictable now? While some further mean-reversion in estimate dispersion is likely, structural uncertainty may mean that analysts struggle to return to their previous levels of forecasting confidence any time soon.