The recent returns of the Energy sector have been dramatic: in just two weeks from its latest trough on November 6th (just before the Pfizer vaccine news hit), the S&P 500 Energy sector rose 37%, the biggest return of any of the major sectors by a wide margin. The overall S&P 500 index, meanwhile, returned only 3.6% in that period. Most recently, the gains in Energy have cooled somewhat, but the sector (as of Dec. 2nd) is still up 30% from its November 6th level, well ahead of all other S&P 500 sector returns over the period.

The magnitude of the outperformance by Energy over such a short period is by far the biggest such move since the S&P sector return data begins in 1989.

This extraordinary move needs to be considered in context however.

It follows a sustained period of massive underperformance by the Energy sector. Over the 12 months through November 6th, the Energy sector had a -51% return, while the overall S&P 500 returned +14%. And in fact, the Energy sector has been underperforming the broader market fairly steadily since December 2016.

So one could certainly argue that Energy stocks were heavily out of favor and due for a rebound, and the recent vaccine news, with its hopes for a return to more normal levels of travel (and thus fuel use), has provided the spark for that rebound.

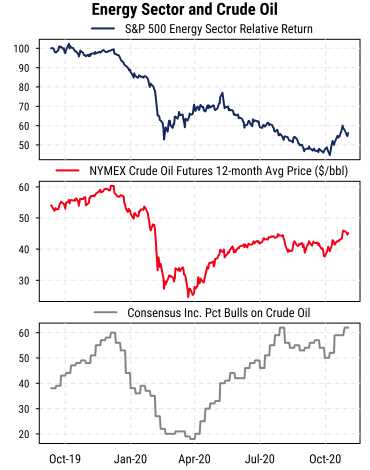

But because of the math of compounded returns, the huge recent outperformance only makes up a fraction of the cumulative underperformance since the start of the year, as reflected in the top section of the chart below.

What about the price of crude oil that so heavily influences Energy stock prices? Interestingly, crude prices have risen recently but less dramatically than the Energy sector stocks have. The average price of crude reflected in the futures markets over the next 12 months (which avoids quirks related to any specific futures contract) is at the high end of the range it has been in since early summer, around $45/bbl but still well below levels seen at the start of the year (middle section of chart). Oil’s recent movements have also been related to the OPEC+ meeting going on now that will influence how much new supply will be put on the market next year, following sharp output cutbacks this year.

Energy stocks continued underperforming over the summer and fall even as crude prices were range-bound, so the recent outperformance of Energy stocks looks more like stock prices catching up with the level of oil prices (after lagging oil’s movements earlier) rather than a response to a new dramatic rise in oil.

Can Energy stocks keep going? While short-term momentum can of course persist, the recent move has been extreme and thus has pushed Energy stocks closer to overbought conditions on a near-term basis. The bigger question is whether crude oil prices will move materially higher and thus help drive another leg higher for Energy stocks.

The near-term outlook for crude does not appear especially favorable for a couple of reasons. First, the current trends in COVID-19 in the US and Europe have led to more concern about travel (and therefore fuel use), not less, at least for now. The vaccines that have been announced will no doubt help, but will not be widely distributed for several months. If OPEC increases production, as they are discussing, prices may not gain much even with better demand.

The other concern is that sentiment toward crude oil is already quite optimistic, according to the surveys of market strategists published weekly by Consensus Inc. The latest readings show 62% of strategists are bullish on crude oil (bottom section of chart), matching the highest readings in the last several years (and far from the historically low readings around 20% in March/April). It is somewhat surprising to see such elevated bullishness given the price action in crude oil – normally sentiment tracks the price trend in the underlying market more closely. This implies that the majority of traders are already positioned for the potential good news from a return to more normal crude demand next year. The risk is therefore the contrarian concern that if most people are already positioned for higher crude prices, the opposite becomes more likely (absent an external shock).

Once Energy stocks have finished catching up with the current level of crude prices, and the heavy pessimism the stocks have faced this year has fully eased, further gains may be harder to come by. High optimism towards crude oil, combined with the potential for increased oil supply if demand does improve, suggests that the longer-term trend of Energy underperformance will be difficult to decisively break on an intermediate-term basis.