12 May 2022

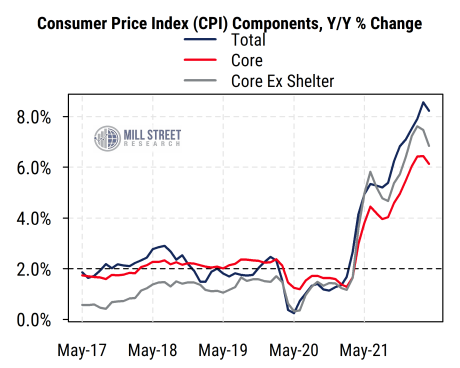

The latest CPI report yesterday showed prices in April still rising at a worrisome rate, led by recovery in service-related spending like airline fares. The monthly increases in the headline CPI and the core (excluding food and energy) rate were both above consensus expectations.

Notably, the core rate (+0.6%) rose substantially more than the headline rate (+0.3%), as the impact of food and energy was negative in April. However, the year-on-year increase in the headline CPI, which eased slightly to 8.3%, is still substantially higher than the core rate of 6.2%.

Source: Mill Street Research, Factset

Source: Mill Street Research, Factset

Either way, the Fed remains under pressure to continue raising interest rates to try to reduce inflation pressures. It does this however, knowing that much of the reason for the current inflation is the disruption of supplies of many things due to COVID (particularly China’s recent lockdowns) and the war in Ukraine. These supply-oriented influences are things the Fed has virtually no control over, and thus can only try to keep demand more in line with the supply by raising the cost of borrowing.

Any signs of hope?

While the inflation picture remains a major source of concern, there are a few signs that the upward pressure on some prices might be easing, and investors may be responding.

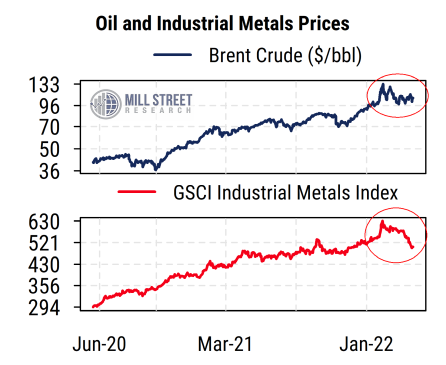

While tracking prices of a representative basket of consumer goods over time is fraught with difficulties, prices for key commodities are readily trackable and can give early clues about underlying inflation pressures.

The price of oil is of course a major input driver, and has been affected by sanctions on Russia following its invasion of Ukraine. After surging earlier this year, crude oil prices have remained volatile but have held within a range since early March (top section of chart below). If step one in limiting overall inflation is to simply halt the rise in a key commodity input, then one could argue that stabilizing oil prices are an initial step in the right direction.

Even more notably, the prices of industrial metals have not only stopped going up, but have actually declined substantially from their early March peak. The GSCI Industrial Metals index tracks a basket of metals including aluminum, copper, lead, nickel and zinc. It has been under heavy pressure recently due in part to a drop in demand from China (also a factor impacting the price of oil), and is down about 20% from its March peak, leaving it roughly unchanged for the year-to-date.

Source: Mill Street Research, Factset

Source: Mill Street Research, Factset

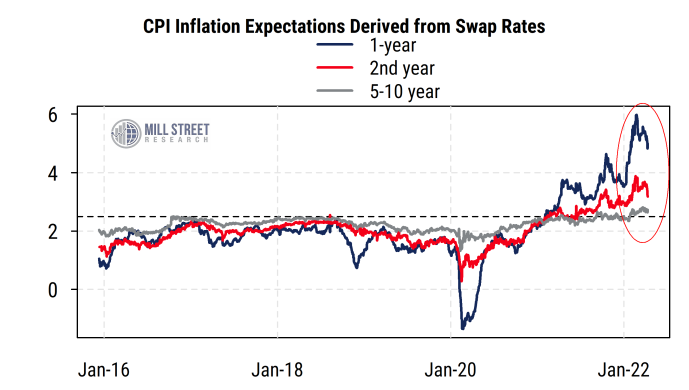

These trends have likely helped drive the easing of inflation expectations visible in the prices of inflation swaps (which pay a return based on the growth of the CPI in return for a fixed interest rate). The near-term inflation expectations have moderated somewhat from their recent peaks, while the long-term (5-10 year) expectations have remained fairly stable near the Fed’s longer-term inflation target of about 2.5% on the CPI.

Source: Mill Street Research, Bloomberg

Source: Mill Street Research, Bloomberg

Housing costs likely to keep CPI elevated near-term

Even if some important commodity prices do moderate (or moderate further), the overall CPI is unlikely to decelerate dramatically due to the influence of its biggest component: housing (or shelter). The CPI uses “owner’s equivalent rent” as its primary measure of housing costs, which essentially estimates the amount a homeowner would pay to rent their house. That component tends to be more persistent than many others, and its year-on-year rate of increase, at 4.8%, has recently hit its fastest pace since 1990.

So while higher mortgage rates and reduced housing affordability will likely put some pressure on home price growth as the year progresses, it will likely take some time for the rent-based housing price component to turn down. Until that happens, the headline CPI could remain elevated. Signs of stability or pullbacks in elevated commodity prices would be a welcome first step, but there are several more steps required before a clear break in inflation pressure will be visible.