24 June 2021

One of the biggest questions we have been getting from clients is “is it time to rotate out of Cyclical/Value sectors toward Growth (or Defensive) sectors?”. Based on our measures of fundamental earnings momentum and macro views, our answer is “not yet”.

There has certainly been rotation in relative returns among Cyclical/Value and Growth sectors recently, along with worries about when the Fed or fiscal policy will shift to a less supportive stance. Our view is that corrections or consolidations after large gains (on an absolute or relative basis) are healthy and to be expected, and that is likely what we are seeing in the Value/Growth relative performance recently.

Our macro view is that the Fed is not likely to turn meaningfully hawkish (tighter monetary policy) any time soon, and the recent reactions to the “dot plot” (Summary of Economic Projections) at the June FOMC meeting were overdone (and quickly tempered). Consequently, we do not see “overly aggressive Fed” as an immediate macro reason to rotate out of Cyclical sectors.

But the more important driver of our view is based on the relative fundamental momentum of cyclical sectors, as measured by the patterns of aggregate analyst earnings estimate revisions activity.

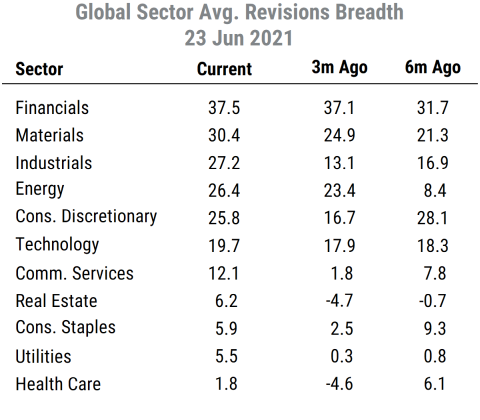

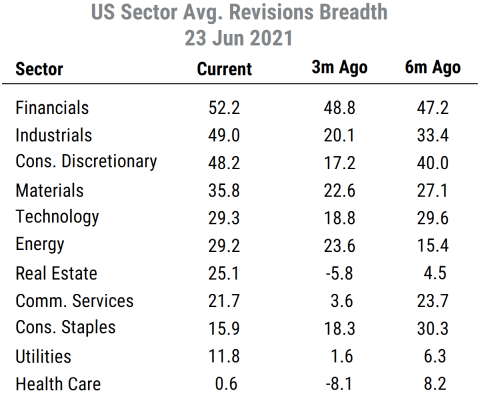

The key tables on this metric are below. For each of the 11 major GICS sectors, we calculate the average proportion of analysts raising versus lowering earnings estimates (using estimates for earnings over the next 12 months). These figures, which we call “revisions breadth”, range from -100% to +100%, with positive readings meaning more analysts raising than lowering estimates on average in that sector (negative readings indicate more estimate cuts than raises). Higher readings indicate more upside surprises that have caused analysts to revise earnings forecasts higher, and thus capture “fundamental momentum” on a forward-looking basis. The readings for all stocks in each sector are equally-weighted.

The first table shows the sector revisions breadth for our broad 6000-stock global universe, while the second table shows the figures for our 2300-stock US universe.

The earnings momentum messages are broadly the same in both: cyclical sectors remain dominant, growth sectors are mid-table, and defensive sectors are weakest.

Source: Mill Street Research, Factset

Source: Mill Street Research, Factset

The strongest sectors continue to be Financials, Materials, Industrials, Energy, and Consumer Discretionary. In the US, Technology is slightly stronger than in the Global data, as is Real Estate.

We can see that the current sector alignment is similar to that seen three months ago or even six months ago, highlighting the persistence of the fundamental trends that can be clouded by short-term volatility in relative returns.

With earnings momentum overall still quite strong globally and in the US, and the sector earnings momentum still strongly in favor of cyclical sectors, the tailwinds for cyclical sector relative returns appear to still be in place. We will continue to watch for signs that it is time to make a more significant rotation toward Growth or Defensive sectors, but we do not see evidence for it yet.