19 January 2022

Central bank policy remains a key focus for investors as rates are set to rise in the US this year, with debate about the pace of the rate hikes and balance sheet adjustment ongoing. However, this is not true everywhere, as there have been growing divergences in expected rate policies among the major developed market central banks.

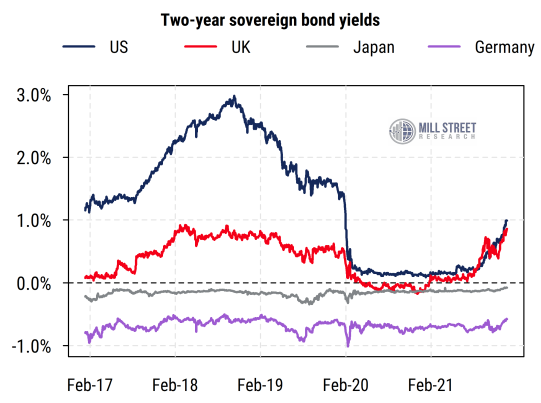

As shown in the chart below of two-year sovereign bond yields for the US, UK, Japan, and Germany (Eurozone), investors are pricing in multiple rate hikes over the next year or two from the US Fed and the Bank of England (BoE): US and UK two-year yields are at or near 1% now, up from around zero for most of the time since early 2020.

Source: Mill Street Research, Bloomberg

Source: Mill Street Research, Bloomberg

By contrast, investors do not appear to expect any such rate hikes from the European Central Bank (ECB), as the benchmark German two-year yields have risen only marginally and remain well below zero (-0.6% currently). A similar pattern is seen in Japanese yields, where the Bank of Japan (BoJ) has engaged in full control of the yield curve for years now and is so far showing no signs of altering its policy of keeping rates across the curve near (or slightly below) zero.

In many ways these divergences in policies also reflect divergences in economic activity and inflation pressures. Europe and especially Japan are seeing less inflation pressure (aside from energy in Europe) than the US and UK are, and that in part reflects the relative level of stimulus that occurred in 2020-21. Perhaps unsurprisingly given the higher rates in the UK, the British pound has appreciated relative to the euro (and the yen) recently, returning to its pre-COVID peak of 1.20 euros per pound. The US dollar has also gained significantly versus the euro since mid-2021.

Even with the US and UK likely to raise rates this year (technically the BoE already raised rates 15bp to 25bp in mid-December), two-year yields of about 1% still reflect expectations of relatively easy monetary policy over the next year or two, especially with elevated inflation in the US and UK. Even if the Fed raises rates to 1.5% by mid-2023 (as current futures prices suggest), negative real policy rates would remain in place given the current expectations for approximately 2.5% inflation after next year.

Thus it bears reiterating that tighter policy (after being extraordinarily loose) is not the same as outright tight monetary policy, especially with Europe and Japan maintaining sub-zero policy rates. As always, markets move ahead of forecastable events, and are adjusting to the new regime of less accommodative monetary policy in some (but not all) countries. This has provoked rotation among styles and sectors within equities as well as a backup in longer-term bond yields. However, if the reason that rates are rising is that economic and earnings growth will remain at or above trend (likely in the US and Europe), then barring a policy mistake of overtightening, equities as a whole should hold up even if somewhat more volatile than last year.