The S&P 500 has reported another strong earnings season for Q4, with 79% of companies beating consensus earnings estimates for the quarter. This would be the third highest such reading in Factset’s data since 2008. The beat rate for top-line sales was similarly high at 77%. Aggregate income for the index is about 4% above year-ago levels, indicating that net income on a quarterly basis has fully recovered pre-COVID levels based on Factset’s data.

However, when we drill down into the earnings trends in the S&P 500 and its component sectors, we see the wide differentials in earnings patterns among sectors.

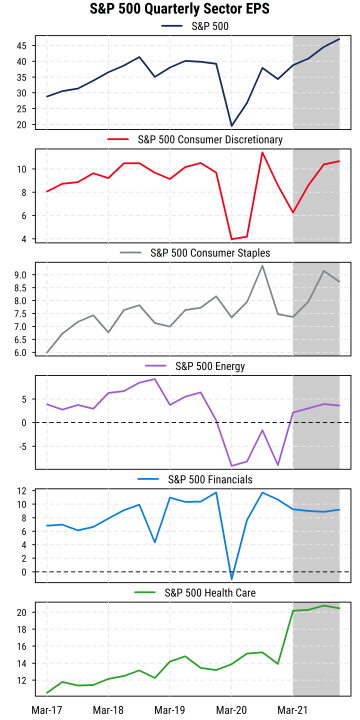

The charts below use quarterly index operating earnings per share as reported by S&P (S&P’s data differ slightly from Factset and other sources). The grey shaded areas are the current bottom-up consensus forecasts for the four quarters of this year.

Source: Mill Street Research, S&P Dow Jones Indices

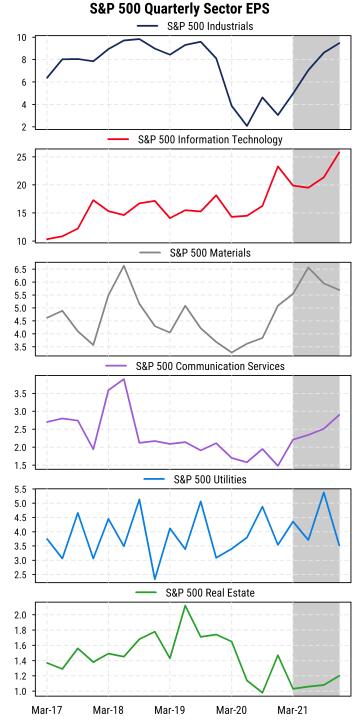

Source: Mill Street Research, S&P Dow Jones Indices

The top section of the first chart above shows us that the overall S&P 500 index is expected to see its quarterly EPS rise steadily over the next few quarters and see quarterly EPS exceed the previous peak of Q2 2019 by Q2 of this year, before reaching a new high of $47.06 by Q4 (which would be up 37% from Q4 2020). The aggregate index figures, however, hide the variation among the 11 sectors that comprise it.

We see that Consumer Discretionary is expected to see earnings recover but not decisively exceed recent highs. Consumer Staples shows a choppy upward pattern, with Q4 expected to be slightly below Q3 of this year.

The Energy sector is expected to rebound from heavily negative earnings during 2020 to moderately positive EPS this year, but still well below the levels seen in 2018 and early 2019 (though if crude continues to rise, that could change).

Financials are expected to see earnings generally plateau around current levels, with no improvement in EPS from Q4 2020 levels, and still near levels seen in 2018-2019. Low net interest margins on lending have been a heavy headwind, partly offset by profits from stock and bond market activity and mortgage-related fees.

Health Care is expected to see a jump in earnings in Q1 of this year and then hold steady at new highs. As we will see, it is thus one of the few sectors where the consensus sees new highs in earnings occurring this year.

Turning to the second chart below with the remaining sectors, see that Industrials (as a classic cyclical sector) had a big drop in earnings in 2020 (with the Transportation component weighing heavily) but is expected to fully recover by the end of this year. Naturally, Industrials should be among the biggest beneficiaries of both fiscal stimulus and re-opening from COVID limitations.

Source: Mill Street Research, S&P Dow Jones Indices

The Technology sector, as one might guess, has been least affected by COVID and almost certainly got a boost in the second half of 2020 due to a surge in spending on IT as workers and companies scrambled to work remotely wherever possible. Consensus calls for earnings to continue growing and reach new further new highs this year.

The Materials sector is seeing a big rebound in earnings from a decline that began well before COVID hit when commodity prices and global growth were already relatively weak. Analysts expect the sector’s earnings to hit a near-term peak in Q2 of this year (matching the 2018 peak) before easing by year-end.

Communication Services has been under earnings pressure for some time, as a mix of some big Tech-related firms along with Telecom, Entertainment and Media firms. Earnings are expected to rise steadily from the current (Q4 2020) lows through the end of this year.

Earnings for the Utilities sector look to remain in a range, with no discernible growth trend visible. Demand for electricity, natural gas, and other utilities has seen little overall growth for years, and regulations in many areas keep revenues and profits relatively stable.

Finally, the Real Estate sector (principally REITs), has seen earnings hit hard by COVID, and the consensus is for only very modest recovery this year as demand for commercial real estate is likely to remain depressed.

Overall, it appears that only the Growth-oriented sectors of Technology and Health Care will see earnings reach true new all-time highs this year. Other sectors may approach or just exceed 2019 levels, while a few have further to go. While fiscal stimulus and re-opening should provide a tailwind for earnings in many sectors, those winds are not blowing at the same speed for all.