In this post, we highlight the interaction of US outperformance versus the rest of the world this year and US Technology relative to Ex-US Technology.

- First, the relative performance of the US equity market versus the rest of the world has been highly correlated with the relative performance of US Technology stocks relative to Ex-US Technology stocks.

- Second, the outperformance of US Technology, and by extension the major US indices versus their non-US counterparts, looks likely to continue based on relative earnings estimate revisions patterns.

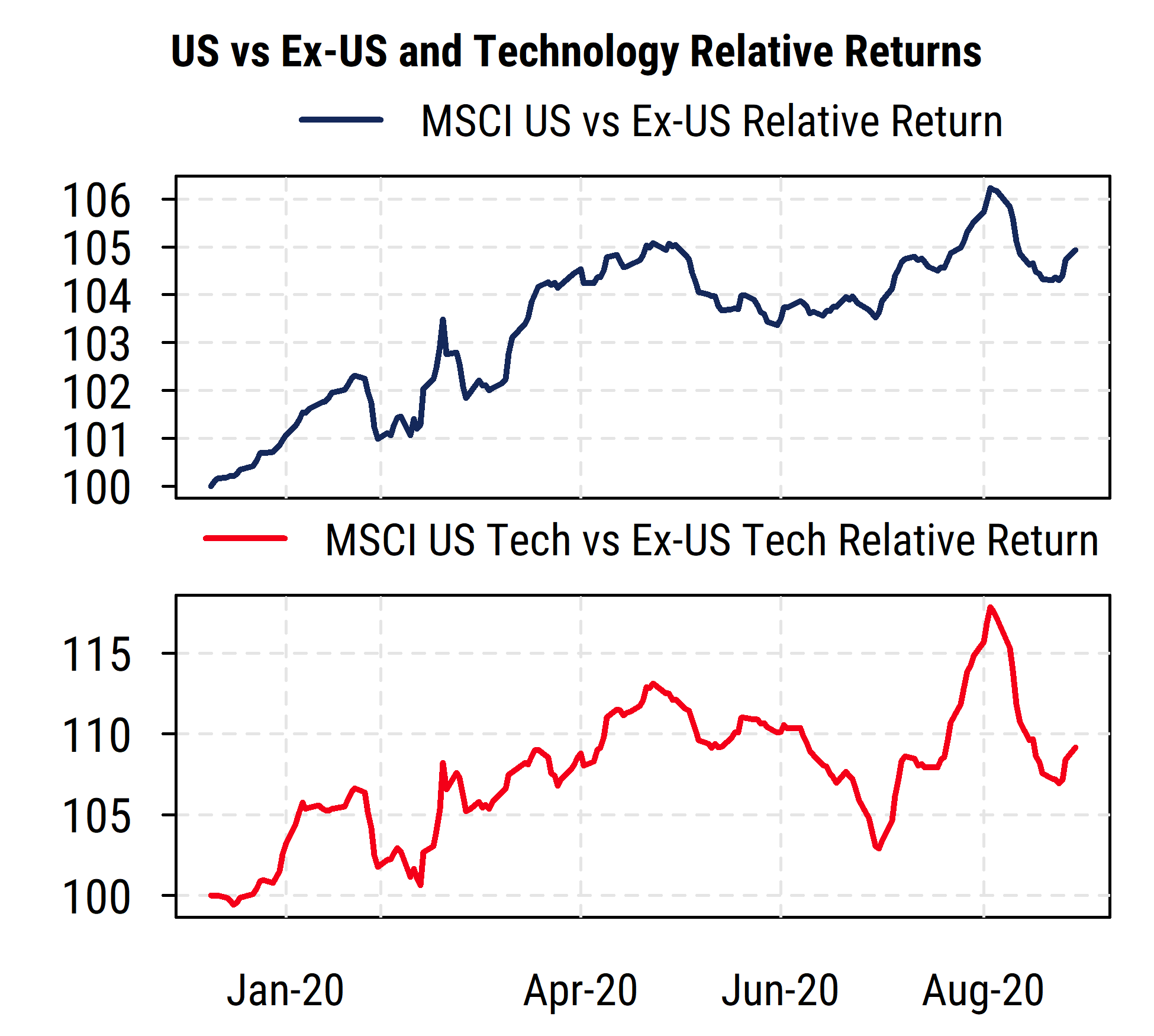

The chart below supports our first point. The US has outperformed the rest of the world this year by a healthy margin, based on the MSCI regional benchmark indices, as shown in the top section (plotted using rolling five-day averages). The lower section isolates the Technology sectors for the US and the Ex-US universe (also using MSCI indices) and plots the relative return of the US versus Ex-US Technology sectors.

We can see the close parallels in the charts for the year-to-date: as US Tech outperforms Ex-US Tech, so does the broader US market outperform the Ex-US aggregate. This in some ways seems unsurprising given the heavy weight that the Tech sector holds in the US compared to many non-US markets, but the relative weights are unrelated to the relative performance of the US versus Ex-US Tech sectors. We find that even after removing the effects of sector weightings, US stocks have outperformed Ex-US stocks this year, and this effect is particularly strong within the Technology sector.

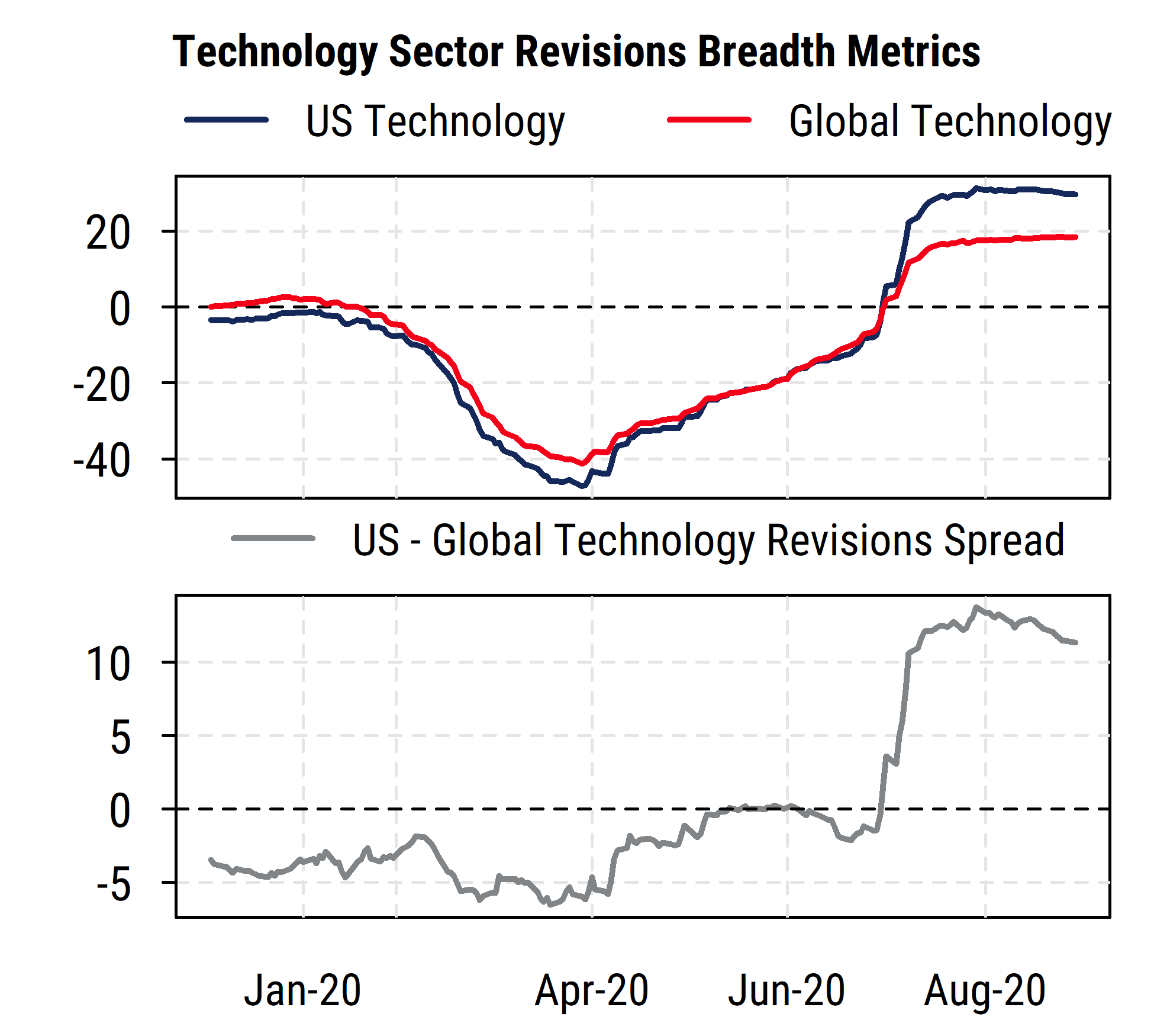

Our second point is captured in the chart below. It shows our measure of aggregated earnings estimate revisions (the percentage of analysts raising versus lowering earnings estimates) for the US Tech sector and the entire Global Tech sector (which includes the US).

We can see here that earlier this year, US and Global Technology estimate revisions (fundamental trends) were mostly moving closely together and slightly favored non-US Tech (US Tech revisions were slightly weaker than Global Tech revisions). Both revision metrics improved sharply from the April lows through today. But the difference between the US and the Global Technology sector earnings estimate measures moved dramatically in favor of the US in July after Q2 earnings reports came out, and have generally remained there ever since. This suggests that US Technology stocks have a strong fundamental tailwind relative to Tech stocks outside the US right now. If that US Technology tailwind persists, the broader US market seems likely to resume outperforming the rest of the world in the coming months.